Add a TAN Number (Optional)

Kaleyra allows you to add TAN (Tax Deduction Account Number) as optional details when you select India as a billing country. TAN helps you in deducting tax at source (TDS) while adding credits to your account. TAN number can be added for both existing as well as new users (with Registered GST or Unregistered GST).

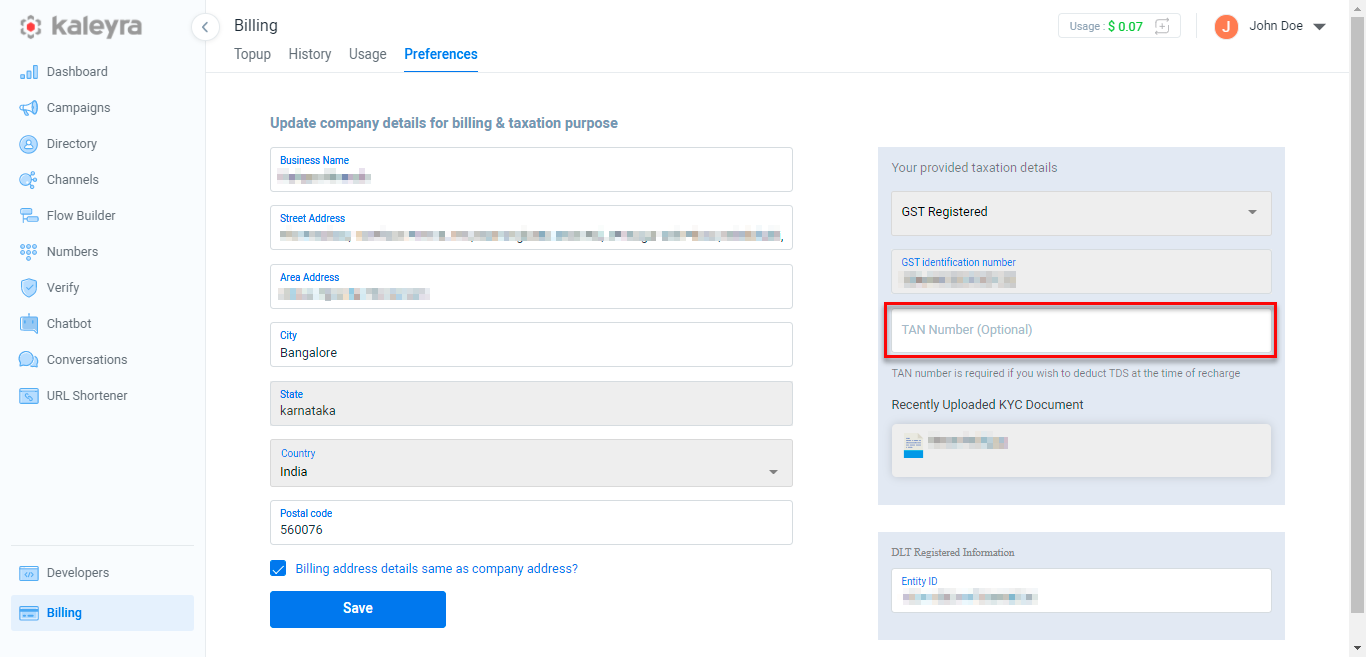

If you are an existing Kaleyra user and if you wish to add your TAN number, perform the following steps:

- Sign in to your Kaleyra.io account.

- Go to Billing and click Preferences.

The Preferences tab detail appears.

- In the TAN Number (Optional) field, enter your TAN number.

Note:The TAN number contains the 10 digits alphanumeric in the following format: ABCD12345E.

- Click Save.

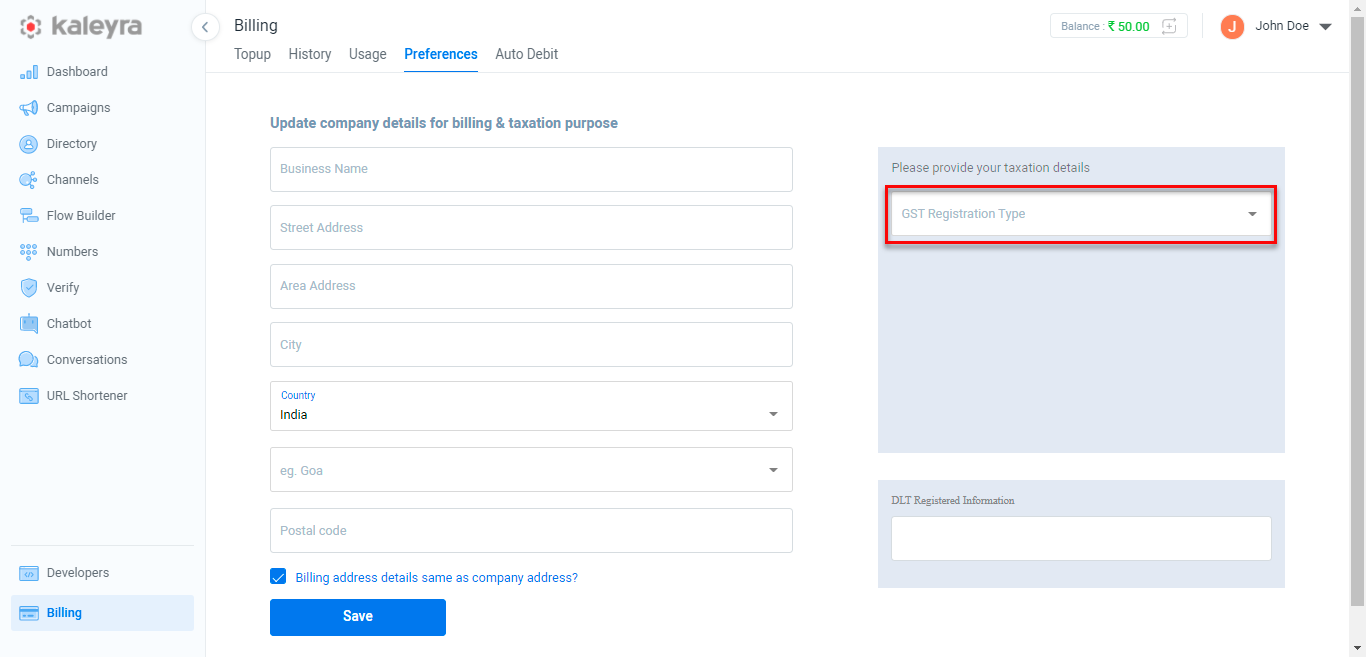

If you are a new Kaleyra user and if you wish to add your TAN number, perform the following steps:

- Sign in to your Kaleyra.io account.

- Go to Billing and click Preferences.

The Preferences tab detail appears.

- From the Please provide your taxation details field, click GST Registration Type, the following option appears:

- Registered

- Unregistered

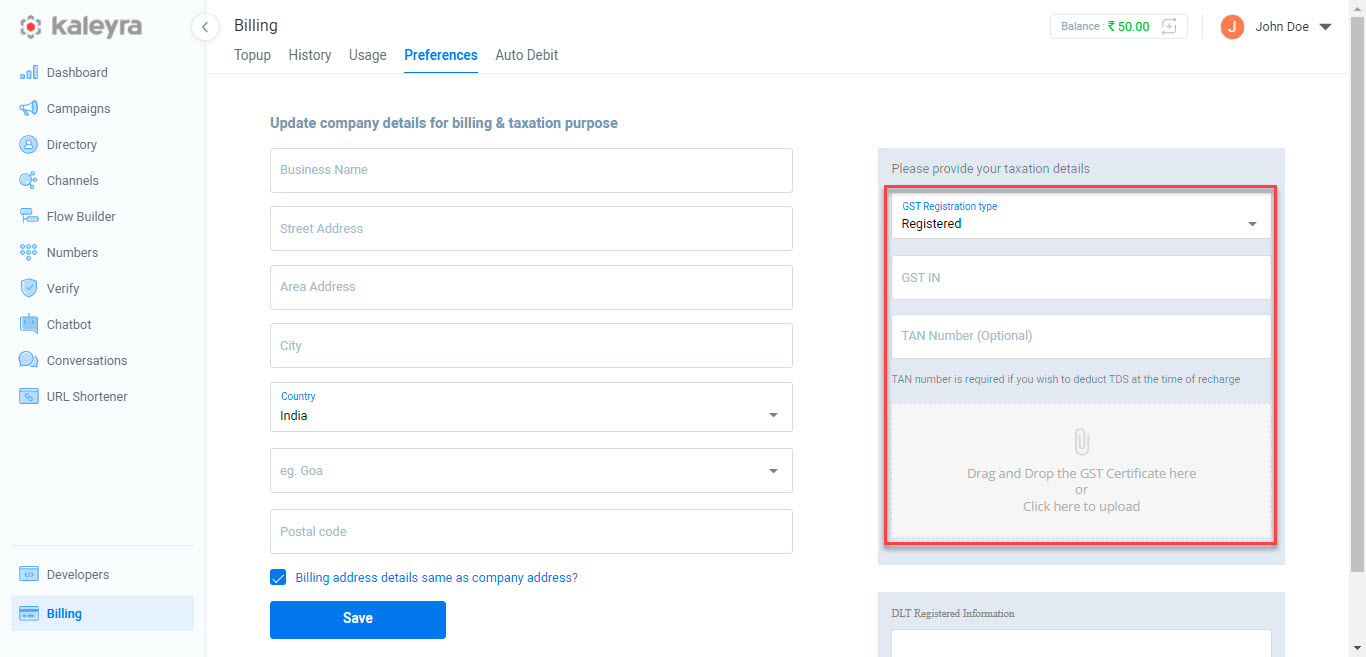

- Select any one of the options. For example - Registered and enter the GST IN.

Note:If you select the Unregistered option, then you have to provide your PAN details.

- In the TAN Number (Optional) field, enter your TAN number.

Note:The TAN number contains the 10 digits alphanumeric in the following format: ABCD12345E. For more information about completing the KYC, see Completing KYC.

- Click Click here to upload and select the GST certificate from the mapped folder. You can even drag and drop GST certificate in the given space to upload.

- Click Save.

Updated 7 months ago